Summary

In the past, we knew the loan origination process for its complexity and lengthy procedures, posing challenges for both lenders and borrowers in the commercial sector. However, with technological advancements in recent times, there has been a transformative shift towards digitization, leading to significant improvements in the lending industry. This digitization has streamlined processes and enhanced operational efficiency, making the loan origination journey much smoother for all involved parties.

In this blog, we will talk about how automation can become a savior for the banking industry in creating an automated loan origination process and address the issues to deliver significant benefits to all stakeholders.

How Automation Can Transform the Loan Origination Process

The loan origination process has traditionally been a complex and lengthy one, posing challenges for both lenders and borrowers. However, technological advancements in recent times have led to a transformative shift towards digitization, which has significantly improved the lending industry.

Digitization has streamlined processes and enhanced operational efficiency, making the loan origination journey much smoother for all involved parties. In this blog, we will discuss how automation can further transform the loan origination process, addressing the challenges that remain and delivering significant benefits to all stakeholders.

The Challenges of the Traditional Loan Origination Process

The following challenges often characterize the traditional loan origination process:

- Complexity: The process can be complex and time-consuming, involving a variety of steps and requirements.

- Manual: Many of the steps in the process are manual, which can lead to errors and delays.

- Inefficiency: The process can be inefficient, with a lot of rework and duplication of effort.

- Compliance: The process must comply with a variety of regulations, which can add to the complexity and time it takes.

- Lack of visibility: it’s difficult to track the progress of a loan application, and to identify any potential problems.

How Automation Can Help

Automation can help to address the challenges of the traditional loan origination process in a number of ways:

- Streamlining: Automation can streamline the process by automating repetitive and manual tasks. This can free up human resources to focus on more strategic and value-added activities.

- Efficiency: Automation can improve efficiency by reducing errors and delays. This can lead to faster loan approvals and a better customer experience.

- Compliance: Automation can help to improve compliance by ensuring that we follow correctly the process, and that they met all regulations.

- Visibility: Automation can provide real-time visibility into the loan origination process, making it easier to track the progress of applications and identify any potential problems.

The Benefits of Automated Loan Origination

The benefits of automated loan origination for lenders and borrowers include:

- Lenders:

- Increased efficiency and productivity

- Reduced costs

- Improved compliance

- Enhanced customer experience

- Borrowers:

- Faster loan approvals

- More convenient and transparent process

- Increased chances of getting approved

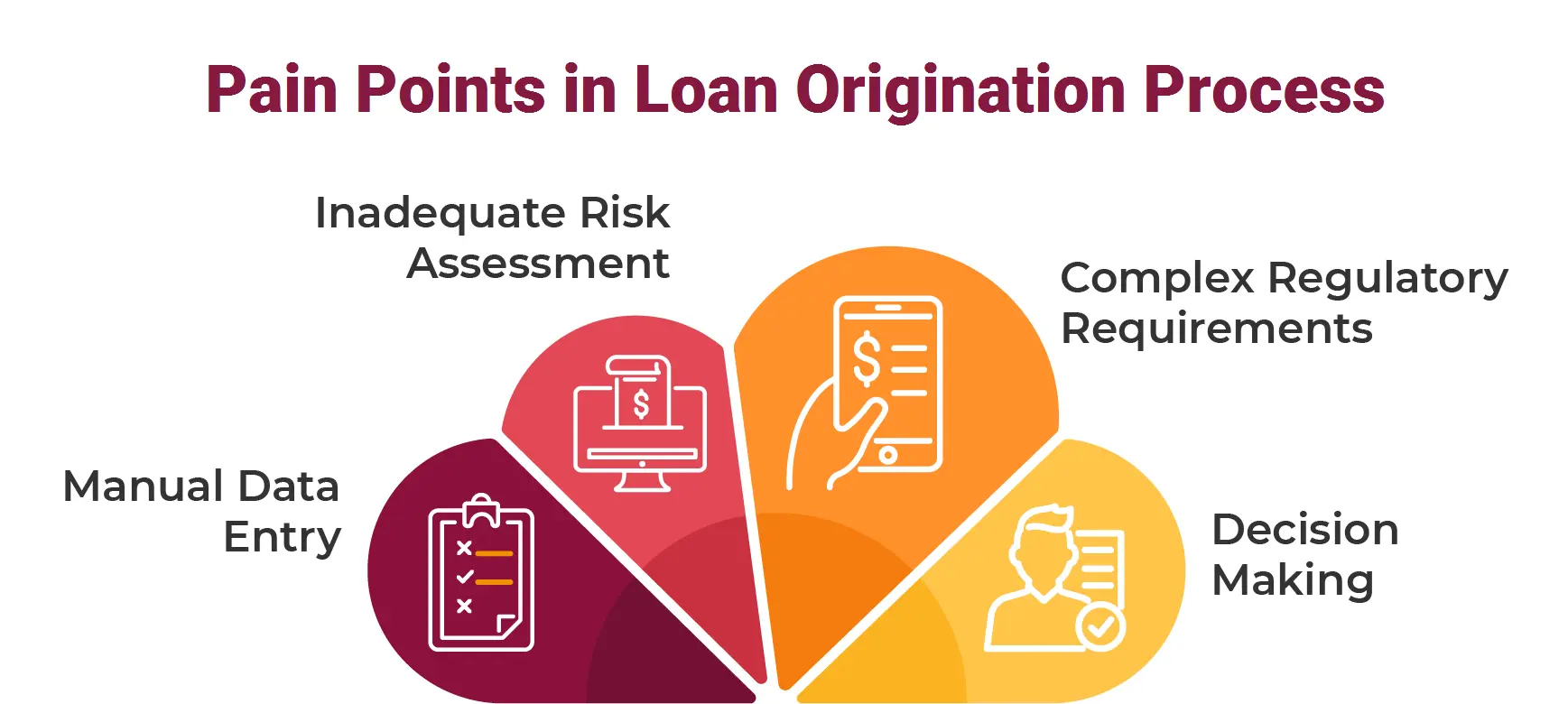

Pain Points in Loan Origination Process

Commercial lending aims to generate economic benefits by funding enterprises, while also ensuring profitability, creating shareholder value, and effectively managing risk for the lenders. Evaluating the creditworthiness of businesses poses a considerable challenge. A typical loan origination process includes multiple steps like-

- Customer Management

- Quality Check

- Credit Analysis

- Decisioning & Approvals

- Funding

They plagued the conventional loan origination process with various pain points and inefficiencies, leading to elevated costs, prolonged processing times, and heightened risk exposure. Some of these pain points and challenges are-

-

Inadequate Risk Assessment

Conventional risk assessment and credit decision-making processes often depend on restricted data and subjective evaluations. These approaches may fail to accurately depict the borrowers’ true risk profile, resulting in less-than-optimal lending decisions and potential losses for the lender.

-

Manual Data Entry

The conventional loan origination processes frequently require laborious manual data entry and document collection. As per a report by Moody’s Analytics one poll, 56% of bankers said manual data entry is the biggest challenge in the loan origination process. This approach is not only time-consuming but also vulnerable to human errors, which may cause delays, inaccuracies, and potential regulatory problems.

-

Decision Making

Traditional risk assessment and credit decision-making methods often depend on limited data and subjective judgments. As a result, they might not effectively capture the borrowers’ true risk profile, leading to suboptimal lending decisions and potential losses for the lender.

-

Complex Regulatory Requirements

Adhering to an ever-changing array of industry-specific regulations and internal policies can be burdensome and time-consuming. Manual compliance processes elevate the risk of non-compliance and could lead to expensive fines or penalties.

By addressing these challenges, the banking industry can streamline the loan origination process efficiently

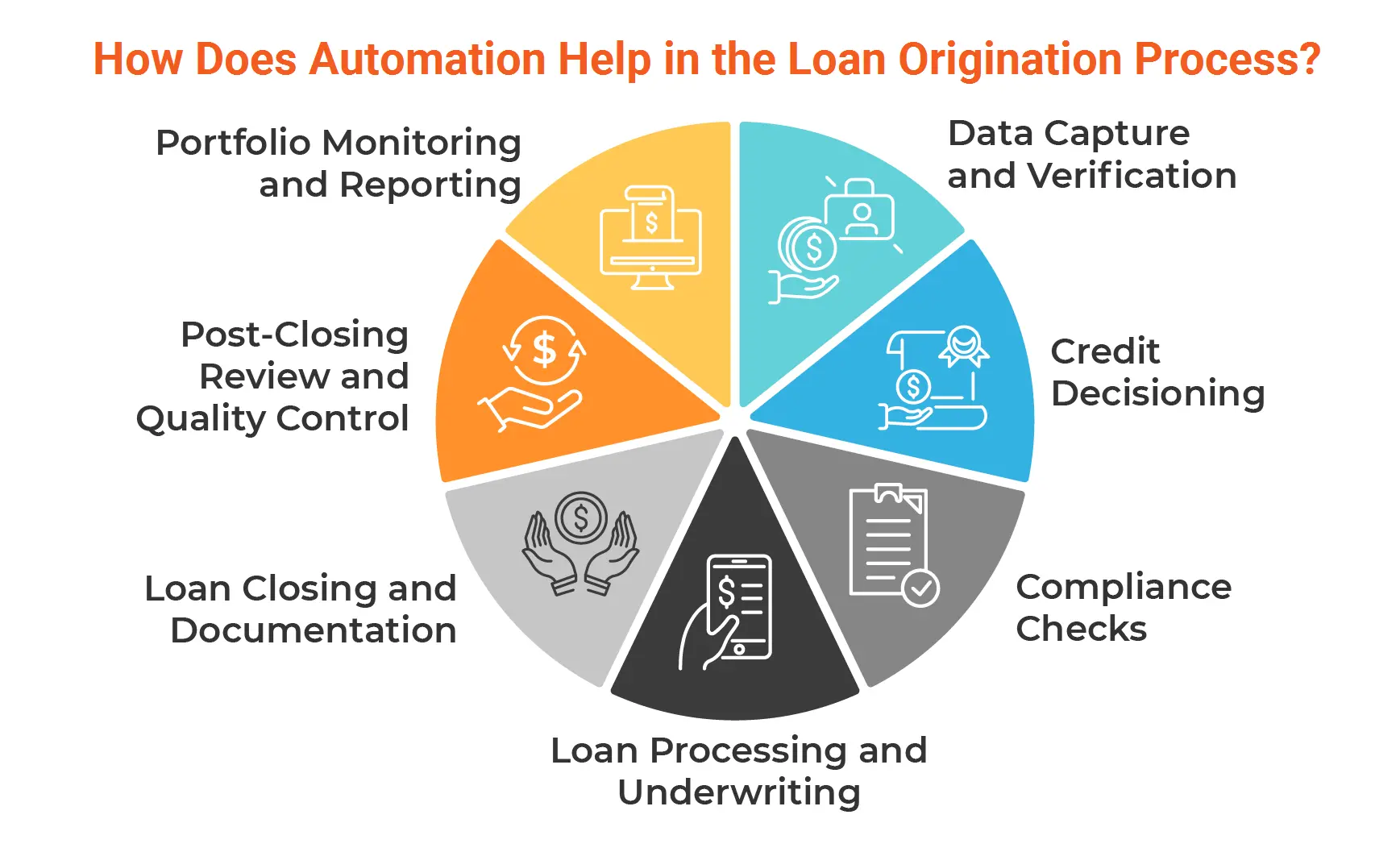

How Does Automation Help in the Loan Origination Process?

Loan automation utilizes automation technologies like RPA, Artificial Intelligence (AI, intelligent data management, and others to revolutionize the loan lending process.

By automating various stages included in the loan origination process, lenders can achieve significant enhancements in efficiency, accuracy, and risk management. Let’s see how automation works in loan origination process

-

Data Capture and Verification

AI-powered solutions like intelligent document processing can automatically extract and validate data from loan documents and eliminate manual data entry to reduce the likelihood of errors. This includes vital borrower information and income details necessary for underwriting.

-

Credit Decisioning

Using machine learning algorithms can analyze vast data sets to generate more precise risk assessments and credit decisions, leading to improved loan portfolio quality. Automated credit scoring models expedite the processing of applications, reducing the time required for credit approval.

-

Compliance Checks

Automation tools simplify compliance procedures by automatically checking loan applications against various regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) rules. This ensures regulatory compliance and minimizes the risk of fines or penalties.

-

Loan Processing and Underwriting

Automated underwriting systems assess borrower risk and make loan decisions based on predefined criteria, expediting the loan approval process. Automation solutions like RPA streamline document review and verification, ensuring all necessary documentation is in place before proceeding.

-

Loan Closing and Documentation

Automated loan processing system facilitates efficient management of the loan closing process by generating essential legal documents and disclosures, tracking deadlines, and managing fund disbursement.

-

Post-Closing Review and Quality Control

Automated quality control checks review closed loans for accuracy and adherence to regulatory guidelines, promptly identifying and resolving any discrepancies or issues.

-

Portfolio Monitoring and Reporting

Automation assists in ongoing monitoring of loan portfolios, generating timely reports on loan performance, delinquencies, and key metrics. This enables proactive identification of potential issues and implementing corrective actions when necessary.

Conclusion

In the highly competitive financial landscape, loan automation presents a promising solution to the challenges faced by commercial lenders. By embracing this technology, lenders can experience reduced operational costs, enhanced efficiency, faster loan processing and approval times, improved risk assessment and credit decision-making, simplified regulatory compliance and reporting, and an overall enhanced customer experience.

Implementing loan automation has the potential to revolutionize the lending industry, as it streamlines the loan origination process, cuts costs, and boosts operational efficiency. As the financial sector continues its digital transformation and embraces hyper-automation platforms like AutomationEdge, we can expect even more sophisticated loan processing automation solutions driven by advancements in AI and machine learning.